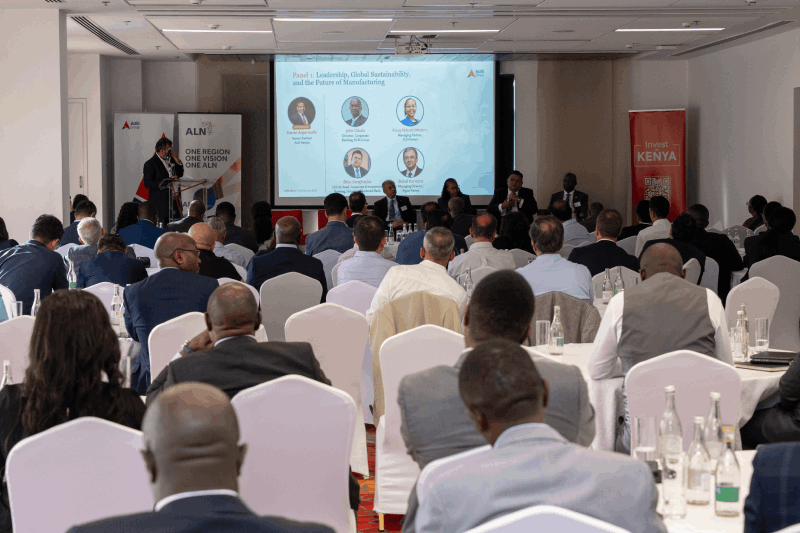

East Africa: A unique business market

East Africa stands out as a significant economic hub, defined by a consistently expanding consumer market and unrivalled market opportunities. With a fast-growing population, the region continues to attract investors due to its promising economic prospects, stable political landscape, and enhanced regulatory framework. Projections predict robust economic outcomes for the region, with local macroeconomic outlooks indicating that its performance will continue to surpass global predictions over the next few years. Numerous investment opportunities continue to emerge in all sectors supported by a dynamic and industrious young workforce that is well-educated and vastly exposed to digital technologies. To serve the needs of investors eyeing the region, Adili has offices in Kenya, Tanzania, and Uganda, from where we provide unparalleled market entry support.

Let Adili guide your market entry journey

Adili is East Africa’s leading corporate consultancy with over 150 years’ experience in supporting businesses at every stage of their journey. We possess the knowledge, agility, efficiency, pan-African experience and diligence needed to create bespoke solutions for our clients to navigate today’s corporate challenges, and ensure that their businesses thrive. Our work ensures that our clients, who range from start-ups and SMEs to multinationals and public-listed companies focus more on their core business and their reputation.

Kenya Overview

- Capital: Nairobi

- Area:582,646 sq km

- Languages:Swahili, English

- Life expectancy:08 years

- Population: 53.01 million

- President: William Samoei Ruto

- Type of Government: Unitary republic with multi-party democracy

- Timezone: GMT + 3

- Currency: Kenyan Shilling (KES)

- Local currency to USD: 1: 141.40

- Calling code: +254

- Economic drivers: In 2021, the services sector contributed about 54.41% to the country’s GDP, followed by agriculture at 22.43% and industry at approximately 16.99%,

- Investment potential: Kenya is the 4th largest economy in Sub-Saharan Africa, and the World Economic Forum’s country competitiveness report ranks it number one (1) in Africa in quality of human capital and availability of research and innovation. The country also has one of the highest rates of internet access in the continent, with 72% of its population having internet access.

What we offer

> Company set-up support

Forms of Incorporation

The Companies Act of 2015 acknowledges several types of companies, which include:

- Companies limited by shares (either private or public)

- Companies limited by guarantee

- Unlimited companies

- Foreign companies

Foreign investors commonly establish a presence in Kenya through two methods: registering a branch of a foreign company (Foreign Company) or incorporating a local company. The latter option is more prevalent due to the advantages of separating the subsidiary from the parent company and the familiarity of regulators with this setup. Licensing procedures for subsidiaries are often easier compared to branches.

- Incorporation of subsidiary companies (Limited Liability Companies)

Our support includes undertaking name reservation, preparing the required documents, executing incorporation papers and submitting applications to the Registrar of Companies.

- Registration of Branches

Our support includes advising on requirements, preparing the required documents, arranging for execution, filing and obtaining registration.

- Beneficial Ownership Disclosures

Every company must identify and maintain a register of its ultimate beneficial owners, and submit their details to the Registrar of Companies. Adili is at hand to offer support in ensuring compliance with regulations around business ownership disclosures.

- Registration with the Kenya Investment Authority

This is a government agency that is mandated to promote and facilitate investment in Kenya by both domestic and international investors. During this process, one is expected to submit a request letter introducing the investor and the company to be issued with a PIN, a letter from the investor appointing the tax agent and an acceptance letter from the tax agent to the investor consenting to the appointment. It is also at this stage that the company presents bank statement(s) of the company/shareholder(s) of the Kenyan entity with at least a balance of USD 100,000.00 or its equivalent in another currency and a project proposal of USD 100,000.00 of investment, or its equivalent in another currency.

- Company Tax Registration

This process involves the registering non–resident director (s) on iTax. The requirements of this process are a notarized copy of the Director’s passport, the postal and physical address, their telephone and email address and a coloured passport-size photograph.

- Application for Value-Added Tax (VAT) Certificates

We offer support in the facilitating the application for VAT registration numbers, and the acquiring Value Added Tax (VAT) certificates. We also facilitate the purchasing and registering of electronic tax devices.

- Registration with the National Social Security Fund (NSSF), National Hospital Insurance Fund (NHIF) and National Industrial Training Authority (NITA)

Our services include facilitating the registration process, following up on the applications, and ensuring that the registration certificates are issued. Additionally, we also help companies register their employees with the NSSF and NHIF subject to different agreements.

- Set up of statutory records

We offer support in the preparing and issuing of share certificates, preparing the first minutes and inaugural resolutions, establishing member registers, registers of directors and registers of secretaries, and purchasing company seals and stamps.

- Assistance in opening company bank accounts

Our work includes preparing the necessary board resolutions and extracts for opening bank accounts, gathering supporting documents, and providing any required company secretary certifications requested by banks.

> Regulatory compliance

- Application for Business Licenses

It is mandatory by law to acquire business licenses before commencing any business activities. Our team is available to offer support throughout the business license acquisition process, which involves:

-

- Collating the required company documents and making business license applications.

- Facilitating the assessment and payment of the license fees.

- Conducting follow up and collection of licenses.

> Employment and immigration matters

- Immigration Support services

We provide professional immigration services based on the latest related country’s immigration laws, professional advice and guidance on the requirements and procedures.

- Payroll services

We offer end-to-end payroll services, supported by top-of-the-line technologies that are key to efficiency and compliance in any organisation.

- Accounting & Book-keeping services

We offer efficient, scalable, and cost-effective accounting and bookkeeping services, designed to seamlessly plug into your business systems. We take care of your accounting needs using reliable accounting systems and reporting tools. Our package comprises a dedicated team of professionals to provide end-to-end accounting services that match your needs.

Talk to our experts

Adili Corporate Services Kenya,

ALN House, Eldama Ravine Road, Off Eldama Ravine Close,

Westlands, Nairobi.

P.O Box 764, Sarit Centre, Nairobi, Kenya, 00606

Tel: +254 709 676 000

Email: info@staging.adili.africa

Tanzania Overview

- Capital:

- Dodoma (Administrative)

- Dar es Salaam (Commercial)

- Area:947,303 sq km

- Languages:Swahili, English, Arabic (only in Zanzibar)

- Life expectancy:41 years

- Population: 61.7 million, a 37% increase over the last 10 years

- President: Samia Suluhu Hassan

- Type of Government: Unitary republic with multi-party democracy

- Timezone: GMT + 3

- Currency: Tanzania Shilling (Tzs)

- Local currency to USD: 1: 2,391.89

- Calling code: +255

- Economic drivers: The main sectors of Tanzania’s economy as per their contribution to the GDP are Construction (16%), Crops (14%), Manufacturing (9%), Wholesale and Retail Trade; Repairs (9%), Transport (8%), Livestock (8%), and Mining and Quarrying (5%).

- Investment opportunity: Tanzania’s investment potential is rising rapidly. In February, the number of registered projects in the country increased by an impressive 128%, with a total of 41 projects registered nationwide.

- Safety: According to the 2019 Global Peace Index, Tanzania is the 7th safest country in Africa.

What we offer

> Company set-up support

Forms of incorporation

- Under the Companies Act, 2002, Tanzania recognizes three types of companies: companies limited by shares, companies limited by guarantee (CLG), and unlimited companies. These companies can be classified as either private or public. Foreign investors commonly establish a presence in Tanzania by either registering a branch of a foreign company or incorporating a local company. The latter option is more prevalent due to advantages such as ring-fencing the subsidiary from the parent company and the familiarity of regulators with the subsidiary setup. This familiarity can streamline licensing procedures compared to setting up branches. Incorporation of subsidiary companies (Limited Liability Companies)

Our support includes undertaking name reservation, preparing and certifying the required documents, executing incorporation papers and submitting applications to the Registrar of Companies.

- Branch Registration

Our support includes providing an Adili nominee to act as the resident person in Tanzania authorized to accept on behalf of the foreign company service of process and any notices required to be served on the company. The Adili nominee also acts as the resident person in Tanzania authorised to represent the foreign company as its permanent representative for the place of business.

- CLG Registration

Presently, an entity in Tanzania can only be registered as a CLG if it is formed with the objectives of promoting commerce, trade and investment or any other activity that is approved by the Minister of Trade as per the provisions of The Written Laws (Miscellaneous Amendments) (No.3) Act, 2019 (the “Amendments”). Our support includes providing the right advice regarding the incorporation of this form of entity.

- Set up of statutory records

We offer support in the preparing and issuing share certificates, preparing the first minutes and inaugural resolutions, establishing member registers, registers of directors and registers of secretaries, and purchasing company seals and stamps.

- Assistance in opening company bank accounts

Our support includes preparing the necessary board resolutions and extracts for opening bank accounts, gathering supporting documents, and providing any required company secretary certifications requested by banks.

- Registered Office Address Service

Our support will include providing the use of our office address as the registered office address of the company in Tanzania and the use of our postal address. We receive communications and notices on behalf of our clients and forward them to the company’s contact person for necessary action to be taken.

> Regulatory compliance

- Application for TIN Certificate

After the certificate of Incorporation/Compliance is issued by the Registrar of Companies, it is mandatory by law to apply for a Tax Identification Number (TIN) within 30 days. Our team is available to offer support throughout the TIN certificate application process, which involves:

- Completing the application forms for submission to the Tanzania Revenue Authority (TRA);

-

- Collating all the required documents for the TIN application.

- Application for confirmation from Serikali ya Mtaa (Local Government Authority);

- Arranging for at least one resident director to appear at the TRA Office, is a mandatory requirement. In the event that the company does not have a resident director, we provide an Adili nominee to hold a Power of Attorney on behalf of the non-resident directors in this regard.

- Following up with TRA and collecting the TIN Certificate.

-

Our support will also include registering the company on the TRA E-Filing system for the purpose of filing tax returns and applying for a tax clearance certificate which is a pre-requisite for business license application. The registration process will require the Company to have an E-Filing System Representative and a Declarant, and we provide both services on behalf of our clients.

- Application for Business Licenses

It is mandatory by law to acquire business licenses before commencing any business activities. Our team is available to offer support throughout the business license acquisition process, which involves:

-

-

- Collating the required company documents and making business license applications.

- Facilitating the assessment and payment of the license fees.

- Following up and collecting licenses.

-

- Application for Value-Added Tax (VAT) Certificates

Registration for VAT is mandatory for every person upon attaining the registration threshold of TZS 100 million in the period of twelve months and above or TZS 50 million in a period of six months ending at the end of the previous months.

We offer support in the application for VAT registration numbers, and the acquisition of Value Added Tax (VAT) certificates. We also facilitate the purchase and registration of electronic tax devices.

- Registration with the National Social Security Fund (NSSF) and Workers Compensation Fund (WCF)

Our services include facilitating the registration process, following up on the applications, and ensuring that the registration certificates are issued.

- Beneficial Ownership Disclosures

Every company must identify and maintain a register of its ultimate beneficial owners, and submit their details to the Registrar of Companies in line with the Companies (Beneficial Ownership) Regulation of 2021. Adili is at hand to offer support in compliance with regulations around beneficial ownership disclosures.

- Company Secretarial Services

It is mandatory by law for a company to have a company secretary during and after incorporation. Adili is at hand to act as your named company secretary and attend to the standard annual compliance and routine secretarial work. We also offer meeting support services for the board of directors and shareholders’ meetings.

- Tax Compliance Services

Adili will be happy to assist you with your tax filings, including filing of corporate income tax returns (preparing tax computations and statement of estimated tax payable and filing with the TRA, advising on the instalment tax to pay to the TRA, and preparing tax computation and return of income and filing with the TRA). We also assist with withholding tax compliance and VAT compliance, if required.

- Registration of Trademarks, Patents and Copyright

Adili is at hand to help you throughout the whole process of your trademark, patent and copyright registration. We provide both registration and post-registration support, including advising you on the information and documents required for each application, submitting the application on your behalf and following up for approval, renewal process, assignment process, application for any changes in the particulars of the owner etc.

> Employment and immigration matters

- Immigration support services

We provide professional immigration services based on the latest related country’s immigration laws, professional advice and guidance on the requirements and procedures.

- Payroll services

We offer end-to-end payroll services, supported by top-of-the-line technologies that are key to efficiency and compliance in any organisation.

Talk to our experts

Adili Corporate Services Tanzania Limited,

Ground Floor, The Address, 1 Bains Singh Avenue, Msasani Peninsula, Dar es Salaam, Tanzania

Telephone: +255 22 260 1212

Mobile: +255 745 210 764

Email: info@adiliafrica.co.tz / silas.nalyanya@adiliafrica.co.tz

Uganda Overview

- Capital: Kampala

- Area:241,038 sq km

- Languages: Luganda, English

- Life expectancy:85 years

- Population: 45.85 million

- President: Yoweri Kaguta Museveni

- Type of Government: Unitary republic with multi-party democracy

- Timezone: GMT + 3

- Currency: Ugandan Shilling (UGX)

- Local currency to USD: 1: 3,705.53

- Calling code: +256

- Economic drivers: The services industry is the biggest contributor to Uganda’s GDP (41.6%) followed by Industry (26.8%) and agriculture (24.1%)

- Investment opportunity: Uganda offers a well-regulated and highly liberalized economy that welcomes investments across all sectors. The country allows free movement of capital, both inbound and outbound, creating a favorable environment for potential investors.

- Economic freedom: The 2019 Index of Economic Freedom ranked Uganda the 8th freest economy out of the 47 Sub-Saharan Africa countries.

What we offer

Forms of Incorporation

The Companies Act of 2012 acknowledges several types of companies, which include:

-

Companies limited by shares (either private or public)

- Companies limited by guarantee

- Unlimited companies

- Foreign companies

Foreign investors commonly establish a presence in Uganda through two methods: registering a branch of a foreign company (Foreign Company) or incorporating a local company. The latter option is more prevalent due to the advantages of separating the subsidiary from the parent company and the familiarity of regulators with this setup. Licensing procedures for subsidiaries are often easier compared to branches.

> Company set-up support

- Incorporation of subsidiary companies (Limited Liability Companies)

Our support includes undertaking name reservation, preparing the required documents, executing incorporation papers and submitting applications to the Registrar of Companies.

- Set up of statutory records

We offer support in the preparing and issuing share certificates, preparing the first minutes and inaugural resolutions, establishing member registers, registers of directors and registers of secretaries, and purchasing company seals and stamps.

- Assistance in opening company bank accounts

Our work includes preparing the necessary board resolutions and extracts for opening bank accounts, gathering supporting documents, and providing any required company secretary certifications requested by banks.

> Regulatory compliance

- Application for Business Licenses

It is mandatory by law to acquire business licenses before commencing any business activities. Our team is available to offer support throughout the business license acquisition process, which involves:

-

-

- Collating the required company documents and making business license applications.

- Facilitating the assessment and payment of the license fees.

- Follow up and collection of licenses.

-

- Application for Value-Added Tax (VAT) Certificates

We offer support in the application for VAT registration numbers, and the acquisition of Value Added Tax (VAT) certificates. We also facilitate the purchase and registration of electronic tax devices.

- Registration with the National Social Security Fund (NSSF)

Our services include facilitating the registration process, following up on the applications, and ensuring that the registration certificates are issued. Additionally, we also help companies register their employees with the NSSF, subject to different agreements.

- Beneficial Ownership Disclosures

Every company must identify and maintain a register of its ultimate beneficial owners, and submit their details to the Registrar of Companies. Adili is at hand to offer support in compliance with regulations around business ownership disclosures.

> Employment and immigration matters

- Immigration support services

We provide professional immigration services based on the latest related country’s immigration laws, professional advice and guidance on the requirements and procedures.

- Payroll services

We offer end-to-end payroll services, supported by top-of-the-line technologies that are key to efficiency and compliance in any organisation.

Talk to our experts

Adili Corporate Services Uganda Limited,

Address: 4th Floor, AHA Towers, Plot 7 Lourdel Road, Nakasero

P.O. Box 28556, Kampala, Uganda

Tel: +256 772 451 960

Email: info@staging.adili.africa